Help! Where’s the good news in Europe?

- By John Chudleigh

- •

- 29 May, 2012

Tired of the media’s daily output of economic gloom with the light at the end of the tunnel ebbing further away? Courage! As they might say en français – please read on.

First, let’s look at the basic facts. We’re told the EU represents conservatively about 40% of the UK’s trade and that the EU’s public spending constitutes nearly 20% of its GDP. Somewhere in there is a hidden figure showing not only how much of that 40% is made up of public spending exports but also the potential to further develop this market.

If you’re tuned into the ticker tape despondency that the news media dish up every second of every minute, you would think this is the last place to find any glimmer of hope given that not only does Europe seem a busted flush but also that the austerity school is still in the ascendency, driving for huge cuts in public spending in many countries. This however is only part of the story in Europe’s complex and disparate economic landscape with tantalising areas of growth in some countries.

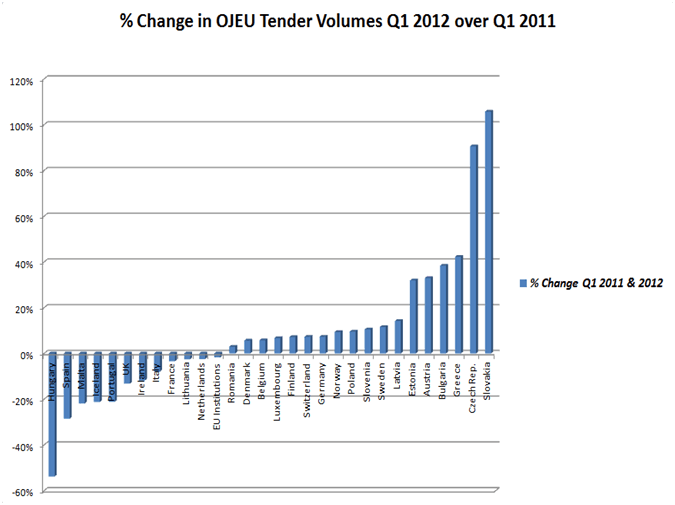

These countries represent not only half of the OJEU’s tender volume but also 44% of its GDP, counterbalancing the shrinkage elsewhere in the previous quarter.

With the exception of Greece, many countries showed positive signs of growth, i.e. not unsustainable public tendering growth with tailspin GDP contraction, but underpinned with GDP growth too.

The Hellenics seemingly spat out their bitter medicine whilst Matron Merkel’s back was turned, counter-intuitively defying the laws of Economics (not Politics!) by increasing the volume (value unknown) of tenders published in the last quarter compared with the same period last year by a staggering 41%. By comparison, the European average was 2% and for the UK -13%, yes minus 13% (see graph below). Using an appropriate Greek word, it is a heroic achievement by anyone’s standards.

So now for the potentially good news… (Cue Alan Freeman Hit Parade theme music!)

Northern Exposure

The Nordics with the exception of Iceland represent not only 9% of Europe’s GDP but also tendering activity and combined with GDP growth across the region at a conservative 1% should not be dismissed. English is commonly spoken and Norway, a member of the European Economic Area is an active participant in OJEU tendering with output comparable to the Netherlands. Uniquely in Europe and probably the world, their public savings exceed their public debts by 160% according to the IMF (i.e. they have lots of money!), and they publish all their tenders in English. One of the ironies of not being in the EU but the EEA is that Norwegian isn’t an official EU language and English is their default tendering language.

New Europe

It’s the EU’s relative neophytes who, using Donald Rumsfeld’s (remember him?) post 9/11 emotive polemics are outpacing ‘old Europe’. Estonia, Latvia, Poland, Slovenia, the Czech Republic, Slovakia and even in the wild east Bulgaria and Romania. Collectively they may only represent 7% of Europe’s GDP, but they are all growing economies (Latvia & Estonia 3% & Romania Bulgaria & the Czech Republic 2%).

The increase in tendering activity between these two Q1 periods was high in Estonia 32% and Bulgaria 38% but most notable were the Czech Republic and Slovakia where growth doubled (see chart) compared with the same quarter in 2011 and supported with GDP growth.

At the moment these are only tasters with maybe some statistical aberrations, but they cannot all be dismissed and for the discerning bidder, looking beyond these shores, need to be taken note of. We will return to this area in future blogs.

The EU institutions (e.g. the Commission, European Development Fund etc.) are included in the comparison chart below separately because with its own budgets, they accounted for 1.4% of all OJEU procurement activity last year, higher than 12 of the studied countries.

The Public Contracts Regulations

Supplies & Services (except subsidised services contracts)

- Central Government bodies £139,688

- Others £214,904

Subsidised services contracts

- All bodies £214,904

Works (including subsidised works contracts)

- All bodies £5,372,609

Light Touch Regime for Services

- All bodies £663,540

Small lots

- Supplies and services £70,778

- Works £884,720

The Utilities Contracts Regulations 2016

Supplies and Services

- All sectors £429,809

Works

- All sectors £5,372,609

Small lots

- Supplies and Services £70,778

- Works £884,720

The Concession Contracts Regulations 2016

- Concession contracts £5,372,609

The Defence and Security Public Contracts Regulations 2011

Supplies and Services

- All sectors £429,809

Works

- All sectors £5,372,609

Small lots

- Supplies and Services £70,778

- Works £884,720

The Public Contracts Regulations 2015 set out a number of rules for publication of public procurement notices on the Contracts Finder portal. For SME's and voluntary or charitable organisations (VCSEs) Contracts Finder offers easier access to public contract opportunities under the WTO GPA procurement thresholds necessitating publication on Find A Tender (FTS).

The notice types found on contract finder are:

1. Early engagement

Inviting feedback from industry on early procurement ideas (also known as ‘pre-procurement dialogue’).

2. Future opportunities

Information on procurements that are likely to be published in the future. The notice can be used to indicate when existing frameworks, or approved supplier lists or contracts are going to be available to be bid on.

3. Opportunities

Live invitations to tender. Used to seek to seek supply chain partners to bid for open public sector opportunities, or to tender for

subcontracts in support of delivering a public sector contract, or for lower value contracts.

4. Awarded contracts

Procurement opportunities that have been awarded to a supplier/suppliers.

We have successfully adapted our multi-lingual search & alerting service to continue to work with the EU's TED / OJEU portal (TED Alert) and the UK's new Find a Tender System (FTS Alert) providing additional alerting flexibility for our customers.

The Public Contracts Regulations

Supplies & Services (except subsidised services contracts)

Schedule 1 bodies £122,976

Others £189,330

Subsidised services contracts

All bodies £189,330

Works (including subsidised works contracts)

All bodies £4,733,252

Light Touch Regime for Services

All bodies £663,540

Small lots

Supplies and services £70,778

Works £884,720

The Utilities Contracts Regulations

Supplies and Services

All sectors £378,660

Works

All sectors £4,733,252

Small lots

Supplies and Services £70,778

Works £884,720

The Concession Contracts Regulations

Concession contracts £4,733,252

The Defence and Security Public Contracts Regulations

Supplies and Services

All sectors £378,660

Works

All sectors £4,733,252

Small lots

Supplies and Services £70,778

Works £884,720

NHSX is a new joint organisation that will be responsible for digital, data and technological initiatives across the NHS. It aims to take forward digital transformation initiatives within the NHS and introduce the latest digital services and technology in the healthcare system.

A statement from the Department of Health and Social Care states that, among its responsibilities, NHSX will reform procurement by:

“helping the NHS buy the right technology through the application of technology standards, streamlined spend controls and new procurement frameworks that support our standards”

NHSX will work closely with the NHS and the wider digital economy, to ensure that patients and staff have access to world-class digital services. Training will be part of this to ensure that staff are “digital ready”.

The new threshold values have been increased by 6% and apply from January 1, 2018

For contracting authorities such as central government departments/agencies and local authorities:

- €144,000 for contracts awarded by central government bodies.

- €221,000 for contracts awarded by local or regional government bodies, or for authorities operating in the defense sector.

- €5,548,000 for works contracts to be awarded by any contracting authority.

For contracting authorities in the utilities sector:

- €443,000 for contracts as part of procurement for services.

- €5,548,000 for works contracts.